When Jessi Vos was a junior in high school, she told her mom and dad she wanted to go to a college that was more international and more urban than the Iowa town where she grew up.

She also wanted a place that wasn’t too big—her state university felt huge—and Christian professors and a Christian campus. (“I’ve learned that a Christ-centered education is the most important thing to me in pursing my college career,” she wrote on one application.)

Her parents wanted all of that for her, too.

“I remember spending time in prayer, saying, ‘Please don’t put my kid or us into a situation where they find the perfect college and we simply can’t afford it,’” her mother, Teri, said. “I talk to parents who say they will figure out a way to make the financial piece work, because you can’t put a price tag on helping your kid be in the best environment possible at this stage of life. But even so, there is going to be a point at which that doesn’t work.”

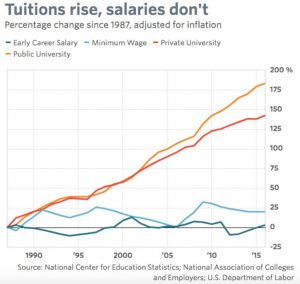

She’s not wrong. The average cost of one year of college—including tuition, fees, room, and board—at an American university doubled between 1988 and 2016, from $11,509 (adjusted for inflation) to $23,091. The price growth was eight times faster than the rate of wage growth during that period.

Among members of the Council for Christian Colleges and Universities (CCCU), the cost is significantly higher—$35,488 a year (though significantly less than the average four-year, private, nonprofit colleges’ price tag of $44,551).

You’d think Christian colleges would be hiring new staff, raising salaries, and starting new programs. In fact, you’d think administrators would be buying yachts and professors would be purchasing vacation homes in the Virgin Islands.

The average cost of one year of college at an American university doubled between 1988 and 2016, from $11,509 (adjusted for inflation) to $23,091.

But that’s not what’s happening.

“The financial health of many Christian institutions of higher education is more precarious than ever before,” Trinity International University president David Dockery wrote in the Christian Education Journal this year. “The rise of costs, the challenge of financial aid, changing tax laws, and unpredictability of funding streams point toward questions regarding long-term viability.”

“There is a real looming crisis, that’s for sure,” said New Saint Andrews College president Ben Merkle. He remembers being at a CCCU meeting where the impending financial future was likened to “driving off a cliff.”

In fact, the situation is worse than Dan Nelson, who has spent the last 20 years surveying financial data for CCCU schools, has ever seen it before.

So what gives? If Christian colleges are charging more than they ever have, why are their bank account balances so low?

Enrollment?

It could be that Christian colleges cost more but are attracting fewer students, so they’re making less money.

That would make sense. But it’s not what’s happening.

That would make sense. But it’s not what’s happening.

While some schools—especially those in areas of the country that are losing population, such as Illinois—are struggling to maintain enrollment, others are growing. And they’re gaining more than the declining colleges are losing.

Overall, CCCU schools’ total headcount rose from about 425,000 in 2012 to nearly 448,000 in 2017. (Full-time student enrollment rose less, from about 302,000 to about 309,000.)

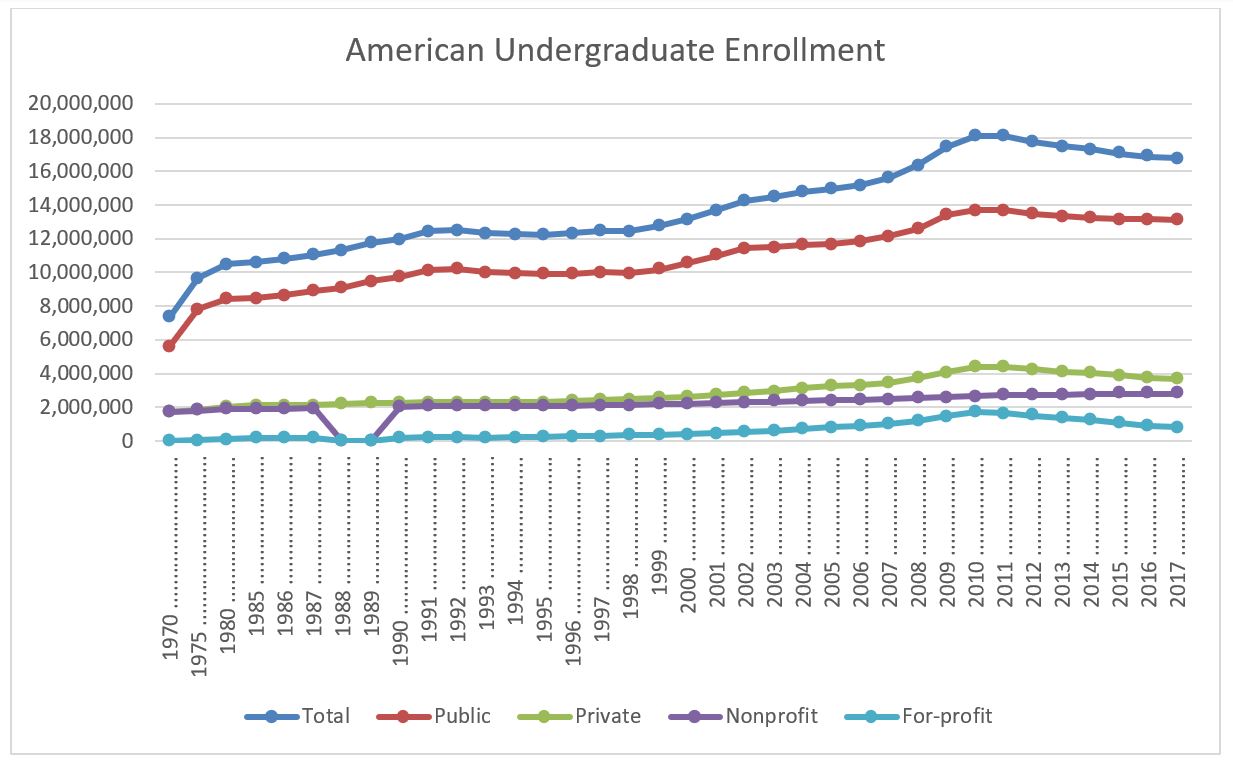

That trend is reflected in both the larger private nonprofit sector and also in public universities. Over the past 20 years, only the for-profit category has lost students, dropping sharply since 2010 after running into multiple lawsuits, negative publicity, and tighter federal regulations.

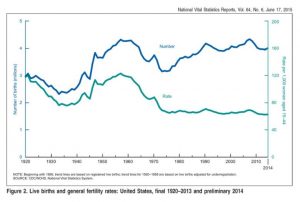

In fact, it seems like attracting students to Christian colleges should be pretty easy. While fertility rates are dropping, Christians still have babies at a higher level than replacement rate—faster than any other religious group except Muslims, according to Pew Research Center.

In addition, the rate of children graduating from public high schools is at an all-time high—85 percent in the 2016–2017 school year, according to the National Center for Education Statistics (NCES).

Most of them—about 70 percent—enrolled in college in 2016. That number didn’t set a record but came close. That meant 19.8 million students were in college in fall 2016—definitely down from the high of 20.6 million in 2012—when the for-profit schools were booming—but still higher than the 15.3 million in 2000 or even the 17.5 million in 2005.

So Christians are having babies, and high schools are graduating students, and those students are going to college more often than ever before. Everything should be great, right?

Recession?

Everything was great, for a while.

“The heyday of Christian higher education was probably from the early 1990s to about 2007,” said Dockery, who was president of Union University in Tennessee for much of that time. At Union, enrollment grew for 16 straight years. The number of donors tripled. The school added more than seven undergraduate majors, six graduate programs, and five doctoral programs.

“I don’t think we realized how privileged we were during those days,” he said. “Enrollments were growing, budgets were increasing, and the Department of Education was friendly toward our efforts.”

That seemed to be true for most Christian colleges. Membership in the CCCU—a network of Christian schools founded in the 1970s—doubled from 88 in 1994 to 176 (including affiliate members) in 2006.

“As an association, it was a great run,” said Bob Andringa, who led the CCCU during those years. The budget almost tripled, from $3.8 million to $10.5 million, the staff jumped from 30 to 65, and the number of programs and projects expanded to 90.

And then, in 2008, the housing bubble popped, the government had to bail out the banks, and the economy deflated. The unemployment rate jumped to 7.2 percent.

On the face of it, this was more good news for colleges. People who couldn’t find a job headed to the classroom; the number of incoming students rose 12 percent in 2008. At CCCU schools, on average, both enrollment and tuition continued to climb.

But under the surface, the financial foundation of many Christian colleges started to wobble.

Trojan Horse

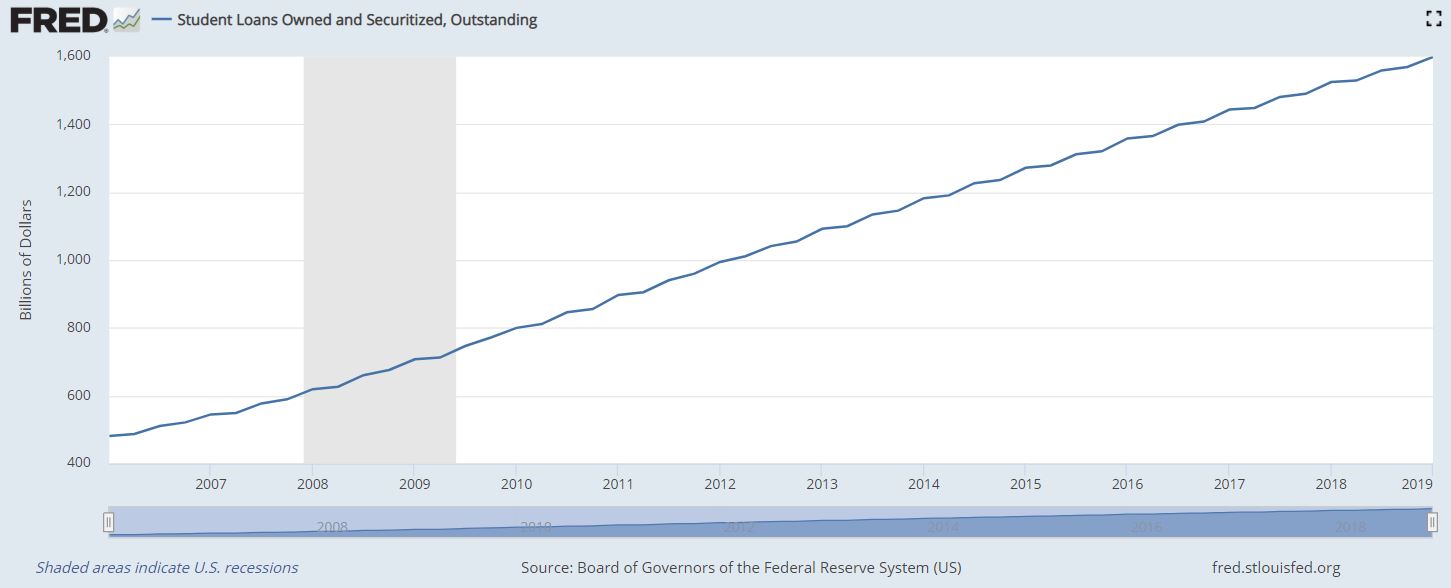

In 1965, out of a desire to make college more affordable to everyone, Congress passed the Higher Education Act. This law allowed the government to guarantee student loans—basically shifting the default risk from banks to taxpayers, which made banks more willing to lend to students. In 1972, Congress followed up with the creation of Sallie Mae, which bought student loans from banks and eventually passed out student loans itself.

During the Great Recession, unemployment, flattening wages, and plummeting home values made tuition payments uncomfortable and sometimes impossible. The default rate ballooned, and the Obama administration introduced the “Pay As You Earn” repayment plan, which capped loan repayment and incentivized even more borrowing.

But it didn’t incentivize everyone.

CCCU students take their loans seriously. Their default rate is half the national average (6 percent versus about 12 percent) and their repayment rate is noticeably higher (78 percent compared to 65 percent).

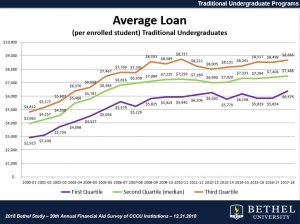

During the Recession, the average amount of money borrowed by CCCU students began to slow down. In some cases, it dropped.

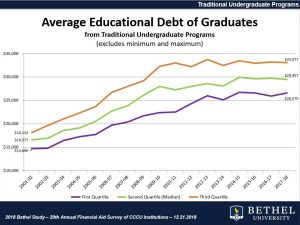

Correspondingly, the average educational debt of a CCCU graduate slowed as well.

“Starting with the recession, there was a shift in the attitudes of families in willingness to sacrifice to send their kid to their first-choice school,” said Nelson, who is the chief institutional data and research officer at Bethel University in Minnesota. “When Mom or Dad went out of work and they went from two incomes to one, they rethought how important it was to go to a higher-cost school.”

(Perhaps not coincidentally, Dave Ramsey’s radio show, books, and classes—which advise against borrowing for anything except a house—continued to skyrocket in popularity during this time.)

Christian parents started looking at less expensive options. By 2018, nearly half of responding CCCU schools (46 percent) told a Bethel University survey that a public university was their No. 1 competition.

“We know people who don’t want their child to look at out-of-state schools because they’re more expensive,” parent Teri Vos said. “They say the same thing about private education vs. public universities.”

“We know people who don’t want their child to look at out-of-state schools because they’re more expensive,” parent Teri Vos said. “They say the same thing about private education vs. public universities.”

That means Christian college recruiters have to work harder.

“My stars, the enrollment operation of liberal arts colleges 40 years ago was to have a couple young graduates who would go out and get your next class,” said Paul Corts, former president of Wingate College, Palm Beach Atlantic University, and the CCCU. Now “the cost of attracting a student is very high.”

Part of that cost is the campus.

“It’s an arms race,” Dockery said. “We all had to do what we needed to compete.” Colleges upgraded their technology and built new dorms, classrooms, and gyms.

At Union, student apartments offer private bedrooms, two bathrooms, and a washer and a dryer. (“They’re spectacular,” Dockery said. “That helped us recruit students.”) At Lee University, a “gorgeous new state-of-the art building with all the robotic equipment” was built for nursing majors, president Paul Conn said. The program, which didn’t exist five years ago, now has 400 majors.

Some of the upgrades were done pre-recession, when budgets were deep in the black, and it seemed like enrollment would ever only grow. Some were done later, in an often-successful bid to attract high-school seniors.

But “all that drove up the price,” Dockery said. Not so much for the construction itself—that was often paid for with capital campaigns—but for ongoing upkeep. “Now we hit a price point, and a lot of parents won’t pay.”

“We’ve overbuilt,” Nelson said.

But that’s not even the biggest problem.

Student Aid

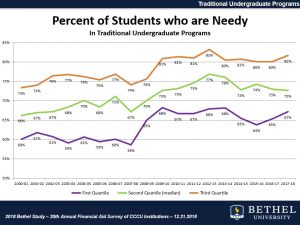

During the Great Recession, the percent of “needy” CCCU applicants rose dramatically, from a median of 67 percent in 2007–2008 to 77 percent in 2012–2013. While the number later dipped, it remains substantially higher than pre-recession levels.

During the Great Recession, the percent of “needy” CCCU applicants rose dramatically, from a median of 67 percent in 2007–2008 to 77 percent in 2012–2013. While the number later dipped, it remains substantially higher than pre-recession levels.

Part of that was their parents’ ability to write tuition checks, which took a sharp dip in 2008 and then leveled off for a few years before beginning to climb again in 2014. But by then, tuition rate increases had left wage increases in the dust.

So schools kept sweetening the deal. The average CCCU discount rate—or the amount given to students as grants and scholarships—rose steadily from around 32 percent in 2006–2007 to 47 percent in 2018–2019. (Other private colleges have taken this same route—the average discount rate for incoming freshmen at private, not-for-profit American universities for the 2017–2018 school year was 50 percent.)

It’s not that Christian high schoolers are pitting CCCU schools against each other, though of course the financial packages they get do weigh into their decisions. More than that, “there is increased aggressiveness from public higher education,” Conn said. “When I was first president [in 1986], the state schools were almost like public utilities that provided a service to the public. They didn’t have the entrepreneurial model. But they do now.”

The average CCCU discount rate has risen to 47 percent.

Conn tells his recruiters, “Right now, our prospects are getting calls from other schools—Kennesaw State University, University of North Carolina, Middle Tennessee State University. Parents are thinking, You can go there with a combination of state grants and a little extra money. That’s probably what we ought to do.”

It’s the Christian parents who have been through the process who are a little savvier when thinking about college costs.

“We’ve learned that the initial price tag you see online and on the paperwork is not necessarily where you’ll land,” Vos said. The range of scholarships—from athletic to academic to leadership to music to theater to just “the average student”—is so wide that “whatever the price tag, no matter your student, [the final cost] can change so much.”

Maybe too much. All that aid means that many schools are giving away scholarships and grants faster than they raise their prices.

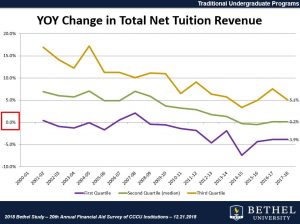

“This is the cause of our schools’ discontent,” Nelson said. “Prior to the recession, the amount of money they netted in a given year was going up by about 5 percent a year.”

That was about perfect. Nelson’s rule of thumb is that a college needs inflation plus 1.5 percent—that extra percent is because colleges spend most of their money paying faculty and staff, who need raises—in revenue in order to thrive. From 2000 to 2008, inflation bounced around 3 percent. Add the 1.5 and you’re right around 4.5 percent to 5 percent.

That was about perfect. Nelson’s rule of thumb is that a college needs inflation plus 1.5 percent—that extra percent is because colleges spend most of their money paying faculty and staff, who need raises—in revenue in order to thrive. From 2000 to 2008, inflation bounced around 3 percent. Add the 1.5 and you’re right around 4.5 percent to 5 percent.

But now, “even with the increase of the family ability to pay in recent years, fully half of our schools are not even netting as much revenue as they did the year before,” Nelson said.

That’s the crux of the crisis—in order to attract students, schools are bringing in less money due to discounted tuition while at the same time spending more on upgrades.

And they haven’t even reached the cliff.

Birth Rate Cliff

After World War II, American GIs came home, married their sweethearts, and started having babies.

From 1946 to 1961, the birth rate skyrocketed. Eighteen years later, the number of high-school graduates peaked at 3.1 million in 1977. (The number wouldn’t get that high again until 2007.)

From 1946 to 1961, the birth rate skyrocketed. Eighteen years later, the number of high-school graduates peaked at 3.1 million in 1977. (The number wouldn’t get that high again until 2007.)

What followed was a bust, then smaller population bumps as the populous Boomers had children and then grandchildren.

When the Great Recession hit, the population of 18-year-olds had just peaked and was entering a seven-year decline—though enrollment was propped up by larger percentages of those 18-year-olds going to college.

That decline lasted only a few years before catching and moving back up. For the past four years, the pool of potential college freshmen has increased.

But it’s easy to see why that increase won’t last. During the Great Recession, like nearly all other times of financial stress, Americans had fewer babies. That rate hasn’t picked back up; in May, the Centers for Disease Control announced that 2018 saw the lowest number of births in 32 years.

“What we see in California is that in 2026–2028 there will be a significant drop off in high-school graduates,” Biola University president Barry Corey said. “If we mirror that, which we have for 60 years, that will affect us—unless we decide now that we’re going to do something different.”

Something Different

In May, Gordon College announced it was working on a 7 percent budget cut, which will include eliminating 36 faculty and staff positions, consolidating philosophy/history/political science into one department, and cutting seven majors—including chemistry, Spanish, and social work.

The school, along with other New England colleges, is already facing the declining numbers of high-school graduates from lower birth rates in that area of the country.

“The short story is that higher education is changing, and Gordon must adapt accordingly,” Gordon announced. “Gordon is taking strategic steps to meet new market realities out of financial prudence and not out of financial distress. (In other words, we’re choosing to be proactive now rather than waiting to be creative later, when financial pressure would be stronger.)”

Other Christian schools are also choosing to consolidate or eliminate shrinking liberal arts departments and lean into STEM fields, where the students are. Still others are adding graduate programs, jumping into technology fields, or moving more courses online.

We have to think outside the box and be innovative. We have to think about, What is the new frontier that is relevant to our institution, that fits who we are?

“Some of us are thinking, Well, we’ve turned up the dials as much as we can on traditional models,” Corey said. “We can’t keep increasing our discount rate or eliminate any more fat or excess. We have to think outside the box and be innovative. We have to think about, What is the new frontier that is relevant to our institution, that fits who we are?”

He recommends schools plan now, before financial pressure means “you have no recourse but to do whatever the new thing is.”

“We’re all so tuition-driven that we have to respond to the market,” Dockery said. “And that’s where the real tensions come, because where do you lose the mission in all of this? It’s not just a matter of surviving. It’s surviving faithfully.”

CCCU president Shirley Hoogstra calls it a “disrupted” time.

“We’re going from something familiar and predictable to something less predictable but on the edge of exciting,” she said. She’s optimistic because in the instability of the higher-education market, Christian colleges have advantages: “Generally, they’re run with financially sound principles. And they have an extraordinary, distinct mission.

“Today’s problems are very complex, which is why I think Christian higher education is needed today more than ever,” she said. “You can’t take out the spiritual components of society and life and expect to get the answers we need for the challenges we have.”

Try Before You Buy: FREE Sample of TGC’s New Advent Devotional

Choosing the right Advent daily devotional can be tough when there are so many options. We want to make it easier for you by giving you a FREE sample of TGC’s brand-new Advent devotional today.

Choosing the right Advent daily devotional can be tough when there are so many options. We want to make it easier for you by giving you a FREE sample of TGC’s brand-new Advent devotional today.

Unto Us is designed to help you ponder the many meanings of this season. Written by TGC staff, it offers daily Scripture readings, reflections, and questions to ponder. We’ll send you a free sample of the first five days so you can try it out before purchasing it for yourself or your church.